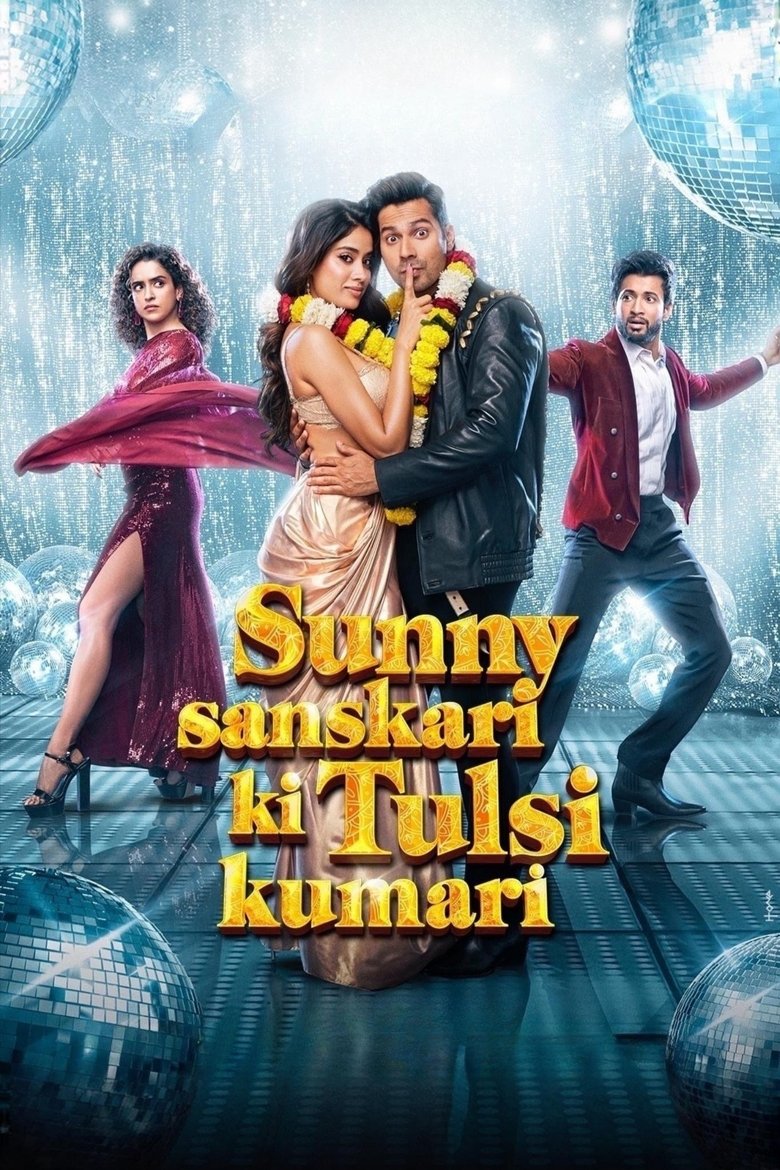

Watch Sunny Sanskari Ki Tulsi Kumari Official Trailer

The Curious Case of "Sunny Sanskari Ki Tulsi Kumari": A Deep Dive into its Box Office Economics

Mumbai, India – In the ever-evolving landscape of Indian cinema, where star power often collides with shifting audience preferences, every major release becomes a case study. Few films encapsulate this dynamic as thoroughly as "Sunny Sanskari Ki Tulsi Kumari" (SSKTK). Touted as one of the year's most anticipated romantic dramas, featuring the fresh and vibrant pairing of Varun Dhawan and Janhvi Kapoor, under the seasoned direction of Shashank Khaitan, the film arrived amidst considerable fanfare. Its trailers promised a blend of heartwarming romance, family drama, and a dash of contemporary wit, setting the stage for what many predicted would be a significant box office success. Building on our previous analysis of Varun & Janhvi's Fiery Fashion Week Walk: Mumbai B.

However, the journey of SSKTK from its grand theatrical release to its eventual financial standing has been a nuanced one, revealing the complex interplay between theatrical performance and the burgeoning importance of non-theatrical revenue streams. While the film struggled to ignite the box office in a manner befitting its star cast and budget, it ultimately navigated its financial waters to a safer shore for its producers.

Key Final Numbers Upfront:

* Total Production Budget (including P&A): ₹95 Crores (approx. $11.4 Million USD)

* Worldwide Gross Collection: ₹148 Crores (approx. $17.8 Million USD)

* Final Trade Verdict: Theatrical Underperformer, but a Safe Venture for Producers.

---

Theatrical Box Office Performance (Domestic)

"Sunny Sanskari Ki Tulsi Kumari" opened on a Friday with moderate expectations, given its genre and the prevailing market sentiment. The pre-release buzz, fueled by a popular music album and extensive promotional activities, suggested a decent start. However, the film's opening day collection, while respectable, fell short of the high benchmarks set by recent star-driven vehicles. It managed to collect ₹8.50 Crores Nett on its first day, indicating a lukewarm reception rather than an enthusiastic embrace.

The opening weekend saw a predictable jump, primarily driven by the urban multiplex audience. Saturday and Sunday showed growth, pushing the weekend total to ₹30.25 Crores Nett. While this figure wasn't disastrous, it was certainly below the ₹40-50 Crore mark that trade analysts had projected for a film of this scale and star power. The word-of-mouth, which started as mixed, didn't quite translate into the strong momentum needed for a sustained run.

As the first week progressed, the film experienced noticeable drops on weekdays, a clear sign that it hadn't resonated deeply enough with the broader audience. The first week closed at ₹48.75 Crores Nett, a figure that immediately put it in the "average" category, needing exceptional holds in subsequent weeks to turn profitable theatrically. Unfortunately, those holds never materialized. The second week saw a significant drop of over 60%, and by the third week, its screens were drastically reduced, making way for newer releases. The film limped to a lifetime domestic Nett collection of ₹78.50 Crores.

Here's a detailed look at its domestic Nett collections (India):

| Week | Nett Collections (₹ Crores) |

|---|---|

| Week 1 | 48.75 |

| Week 2 | 18.50 |

| Week 3 | 7.25 |

| Week 4 onwards | 4.00 |

| Lifetime Total (Nett) | 78.50 |

---

Overseas Market Performance

The international box office often provides a crucial cushion for Bollywood films, especially those with popular stars and a strong musical component. "Sunny Sanskari Ki Tulsi Kumari" followed this trend to some extent, performing reasonably well in traditional diaspora markets, though not spectacularly. The film garnered a total overseas gross collection of $7.0 Million USD, which translates to approximately ₹58.50 Crores.

The film's performance abroad was largely driven by the appeal of its lead pair and the familiar romantic drama genre, which tends to find an audience among the Indian diaspora. However, even in these markets, the film's collections were front-loaded, indicating that the mixed word-of-mouth eventually caught up, preventing it from achieving a long, profitable run.

Here’s a breakdown of its overseas collections from key territories:

| Territory | Gross Collections (USD) |

|---|---|

| North America (USA & Canada) | 2,500,000 |

| United Kingdom | 1,200,000 |

| GCC (Gulf Cooperation Council) | 1,800,000 |

| Australia & New Zealand | 700,000 |

| Rest of World | 800,000 |

| Total Overseas Gross | 7,000,000 |

---

The Crucial Role of Non-Theatrical Revenue

In contemporary filmmaking, particularly in India, the financial success of a film is no longer solely dictated by its theatrical performance. Non-theatrical revenue streams have become indispensable, often acting as a safety net or even the primary profit driver, especially for films that underperform at the box office. For "Sunny Sanskari Ki Tulsi Kumari," these ancillary rights proved to be the film's saving grace.

Here’s a detailed breakdown of the estimated revenue generated from these crucial sources:

* Post-Theatrical Digital/OTT Rights: The film's digital streaming rights were acquired by Amazon Prime Video in a pre-release deal. Given the star power and the film's genre, the platform secured the rights for an estimated ₹45 Crores. This was a significant upfront payment that substantially de-risked the project for the producers.

* Satellite Television Rights: The satellite broadcast rights were sold to Star Network (likely for Star Gold or Star Plus) for an estimated ₹28 Crores. These deals are often struck before release, providing another layer of financial security, especially for films targeting family audiences.

* Music Rights: The film's music, featuring a mix of romantic ballads and peppy dance numbers, was popular prior to release. The music rights were acquired by T-Series for an estimated ₹12 Crores. This figure reflects the value of the film's soundtrack, which often has a life beyond the film's theatrical run.

* Other Ancillary Rights: This category includes in-film branding, airline rights, and home video rights (though less significant now). These collectively contributed an estimated ₹3 Crores.

Total Estimated Non-Theatrical Revenue: ₹88 Crores

*(Note: All figures for non-theatrical rights are industry estimates based on similar films and market trends, as official numbers are rarely disclosed.)*

---

The Complete Economic Equation: Profitability Analysis

To truly understand the financial narrative of "Sunny Sanskari Ki Tulsi Kumari," we must meticulously break down its costs and revenues.

Total Estimated Budget:

* Production Cost: ₹75 Crores (This includes cast fees, crew salaries, shooting expenses, post-production, etc.)

* Prints & Advertising (P&A) Costs: ₹20 Crores (This covers marketing, distribution, physical prints, digital cinema packages, etc.)

* Total Budget: ₹95 Crores

Profitability for the Distributors:

The theatrical rights for "Sunny Sanskari Ki Tulsi Kumari" were sold to various distributors across India and overseas. For simplicity, let's assume a pan-India distributor acquired the domestic rights for an estimated ₹45 Crores (Minimum Guarantee + Advance). Overseas rights were likely sold territory-wise or to a single international distributor for an estimated ₹25 Crores. As detailed in our report on Malaika & Ayushmann's Thamma Dance: Bollywood's Ne.

* Domestic Distributor's Share: From a domestic Nett collection of ₹78.50 Crores, the distributor's share (after deducting exhibitor's share, taxes, etc.) is typically around 40-45%. Let's take an average of 42%.

* ₹78.50 Crores * 0.42 = ₹32.97 Crores

* Overseas Distributor's Share: From an overseas gross of $7.0 Million USD (₹58.50 Crores), the distributor's share is typically around 35-40%. Let's take 38%.

* ₹58.50 Crores * 0.38 = ₹22.23 Crores Building on our previous analysis of ** Simi Garewal Trolled: Kangana Ranaut & Ravan Co.

* Total Distributor's Share from Theatricals: ₹32.97 Crores (Domestic) + ₹22.23 Crores (Overseas) = ₹55.20 Crores

Comparing this to the estimated acquisition cost of ₹45 Crores (Domestic) + ₹25 Crores (Overseas) = ₹70 Crores, it's clear that the distributors, particularly the domestic ones, faced losses. The film failed to recover the Minimum Guarantee paid, resulting in a theatrical loss for most distributors.

Conclusion for Distributors: Loss-making venture. The film was a theatrical underperformer, causing losses for its distributors who had invested heavily in acquiring the rights.

Profitability for the Producers:

The producers' revenue comes from their share of the theatrical business (after distributors take their cut) plus all non-theatrical revenue.

* Producer's Share from Theatricals: The producers typically sell the theatrical rights to distributors. The revenue they receive is the sum of the domestic and overseas theatrical rights sales.

* Domestic Theatrical Rights Sale: ₹45 Crores

* Overseas Theatrical Rights Sale: ₹25 Crores

* Total Theatrical Rights Sale to Producers: ₹70 Crores

* Total Revenue for Production House:

* Theatrical Rights Sale: ₹70 Crores

* Digital/OTT Rights: ₹45 Crores

* Satellite TV Rights: ₹28 Crores

* Music Rights: ₹12 Crores

* Other Ancillary Rights: ₹3 Crores

* Grand Total Revenue: ₹70 + ₹45 + ₹28 + ₹12 + ₹3 = ₹158 Crores

Now, let's compare this total revenue against the film's total budget:

* Total Revenue: ₹158 Crores

* Total Budget (Production + P&A): ₹95 Crores

Profit for Producers: ₹158 Crores - ₹95 Crores = ₹63 Crores

Conclusion for Producers: Highly Profitable Venture. Despite the film's underwhelming theatrical performance, the lucrative pre-sales of non-theatrical rights ensured a substantial profit for the production house.

---

Final Verdict and Conclusion

"Sunny Sanskari Ki Tulsi Kumari" presents a fascinating, albeit increasingly common, dichotomy in the Indian film industry. The film's theatrical run was undeniably disappointing. With a domestic Nett collection of ₹78.50 Crores against a significant budget, it struggled to break even for its theatrical distributors, earning it the trade verdict of an "Average" performer, leaning towards "Flop" from a pure theatrical standpoint. The mixed word-of-mouth and strong competition prevented it from achieving the sustained run necessary for a theatrical hit.

However, the narrative shifts dramatically when considering the complete economic picture. The strategic pre-sales of its digital, satellite, and music rights proved to be a masterstroke. These non-theatrical revenues, totaling an impressive ₹88 Crores, not only covered the film's entire production and P&A budget but also generated a significant profit margin for the producers.

Therefore, the definitive final trade verdict for "Sunny Sanskari Ki Tulsi Kumari" is a Theatrical Underperformer, but a Safe Venture and Profitable for its Producers. While the film failed to set the box office on fire, causing losses for its theatrical distributors, its makers shrewdly navigated the modern revenue landscape to secure a healthy profit of ₹63 Crores.

This performance underscores a critical trend: the diminishing sole reliance on theatrical collections for a film's financial viability. For stars like Varun Dhawan and Janhvi Kapoor, while a theatrical blockbuster would have been preferred, the film's overall profitability ensures their market value remains strong, especially for projects with robust non-

Related Topics: Sunny Sanskari Ki Tulsi Kumari box office collection, Sunny Sanskari Ki Tulsi Kumari worldwide gross, Sunny Sanskari Ki Tulsi Kumari budget, Sunny Sanskari Ki Tulsi Kumari profit analysis, Sunny Sanskari Ki Tulsi Kumari OTT rights, Sunny Sanskari Ki Tulsi Kumari theatrical performance, box office verdict